This memorandum is to summarize Japan individual income tax on salary income principally for expatriate employees and directors in Japan. Another focus of this memorandum is stock remuneration currently more prevalent, but its taxation is not as straight forward as cash remuneration’s.

US tax information is inserted to compare with Japan tax and illustrate differences between two countries which might lead to tax duplication.

US tax information is inserted to compare with Japan tax and illustrate differences between two countries which might lead to tax duplication.

Topics;

- Filing individual income tax return

- Scope of Japan tax on salary income

- Source allocation of compensation for service rendered inside or outside Japan

- Income tax on stock award as compensation for service

- International tax duplication

- Tax planning mainly on stock award

I. FILING OF JAPANESE INDIVUDUAL INCOME TAX RETURN

- Filing the individual income tax return annually by March 15 on the taxable income of the previous calendar year

- Extension of the filing due date is generally not acceptable

- Failure to file penalty: 15% on tax liability up to JPY500,000 and 20% on tax liability beyond.

- No filing status. Married filing jointly is unavailable in Japan.

- Resident is not required to file tax return if the taxable income is limited to salary paid in Japan not exceeding JPY20,000,000 from which the employer withheld income tax and duly settled.

- Annual income tax final liability is due on the same as of the filing due date, i.e. March 15 unless bank account withdrawal on April 20 is applied.

- Failure to pay penalty: 2.7% on tax liability until 2 month after the filing due date and 9.0% thereafter (Rate is subject to change after 2017)

- Statute of limitations on assessment: 5 years from due date of return (7 years in case of fraud or false returns)

II. TAX ON SALARY INCOME

1. Scope of Japan tax on individual income

Scope of Japan’s taxable individual income varies on tax payer’s residency status as follows;Chart 1.

| Resident status | Taxable income | |

| Resident | Permanent resident | Worldwide income |

| Non-permanent resident | Non-foreign source income and foreign source income paid in Japan or remitted into Japan | |

| Non-resident | Japan source income | |

Comparison with US tax is illustrated below;

Chart 2.

Country |

Nationality |

Residency |

Taxable income |

| US tax | US National (US Citizen) | Resident | Worldwide income |

| Non-resident | |||

| Foreign national (Alien) | Resident alien | ||

| Non-Resident alien | US source income | ||

| Japan tax | Japan National | (Permanent) Resident | Worldwide income |

| Non-resident | Japan source income | ||

| Foreign national | Permanent resident | Worldwide income | |

| Non-permanent resident | Non-foreign source income and foreign source income paid in Japan or remitted into Japan | ||

| Non-resident | Japan source income |

From general tax principle of resident taxed on worldwide income and non-resident taxed on the income raising within the country, US and Japan have following variation.

- US taxes US citizen on its worldwide income regardless of residency;

- Japan places a hybrid category of "non-permanent resident" exempt from Japan income tax on foreign source income if it is neither paid in Japan nor remitted into Japan.

2. Residency Status

Chart 3.| Possession of domicile or residence (Note) in Japan | Residency status | ||

| None or Less than 1 year | Non-resident | ||

| For 1 year or more | Aggregate period of possession in the past 10 years | Not exceeding 5 years | Non-permanent resident (or Permanent resident if either Japanese national or those who declares the intention of permanent residency) |

| Exceeding 5 years | Permanent resident | ||

(Note)

- Domicile: Center of living recognized by facts and circumstances of address, profession, location of family and property.

- Residence: Place to stay for a certain period but not recognized as center of living

- Those who stay in Japan for work is assumed to possess domicile in Japan unless the assignment letter or other proof demonstrates the length of the stay less than a year.

3. Tax rate on salary income

In US director’s remuneration is classified as self-employment income, while in Japan remuneration for service of both employee and director is categorized as salary income. In this memorandum, salary income refers to remuneration for both employee and director unless otherwise mentions.Tax rate of Japan income tax on salary income is added to Chart 1 as follows;

Chart 4.

Resident status |

Taxable salary |

Tax rate on salary income |

|

| Resident | Permanent resident | world-wide (salary of Japan source and foreign source) | Progressive tax rate ranging from 15 to 56% (56% on tax base over JPY40 million) on tax base after aggregation with other source of income (Note) |

| Non-permanent resident | Japan source salary and foreign source salary paid in Japan or remitted into Japan. (Director’s remuneration of Japanese company is entirely Japan source.) | ||

| Non-resident | Only Japan source salary | Fixed at 20.42% | |

4. Japan source salary income

Employee’s salary income including taxable fringe benefit is subject to source allocation on time basis of days of physical presence either inside or outside Japan as follows.Japan source salary income of employee:

| Compensation attributable to the period | X | (A) minus Number of days of business trip outside Japan Number of days to which the compensation is attributable (A) |

For the non-permanent resident employee who spends substantial days of overseas business trips, salary paid outside Japan is more tax favorable as long as it is not remitted into Japan because overseas business trip reduces taxable income in Japan (Chart 4).

(Note)

- Adjustment for days of home leave should be inserted to the calculation.

- Source allocation of salary income is not available to director’s remuneration paid or borne by Japanese company because it is entirely regarded as Japan source income (Chart 4). Expatriate’s director status of Japanese company curtails tax merits which would be otherwise available if the expatriate was an employee during the initial 5 years period after entry into Japan.

- As for US tax, IRS also applies the time basis allocation for salary, except for certain fringe benefits on geographical basis allocation (housing benefit allocated by the location of principle place of work and tax reimbursement allocated by the location of tax jurisdiction), unless the taxpayer demonstrates and IRS accepts alternative basis as a more proper determinant than time basis or geographical basis. Japan applies generally the time basis to overall compensation including fringe benefits.

- US tax applies the time basis allocation of remuneration of not only employee but also of director. On the other hand US-Japan tax treaty allows resident country of the company of which the director is a board member to tax on such director’s remuneration. Director remuneration of non-resident alien under US tax (Chart 2) in Japan who is a board member of the US company is taxable not only in Japan but also in US but to the extent of US source portion on time basis (not limited to US source portion in case of US citizen and resident alien under US tax (Chart 2)). This is further extended to III. 8.(3).

III. INCOME TAX ON STOCK AWARD TO EMPLOYEE AND DIRECTOR

1. Stock award for employee and director

Among various types of stock award as deferred compensation for service, income tax on following 3 types of stock award are summarized here.(1) Stock option:

- option as payment for services to buy stock at a fixed price

- Stock granted under certain restrictions typically including vesting schedule

- Stock issued at grant but retained by company while employee usually holds voting right and dividend after the grant

- Unsecured promise to pay a set number of stock upon completion of vesting schedule.

- No stock issued at grant, consequently no voting right nor actual dividend endowed until vesting

2. Taxable event on stock award

Stock award can be classified into either tax deferral type or non-tax deferral type as to whether taxable event defers until sale of the underlying stock subject to capital gain taxation.- Tax Deferral type (Statutory stock option) Tax deferral is allowed only to the stock option meeting certain conditions designated by the law. Income tax is charged at the time of sale of the underlying stock as capital gain, but the capital gain is attributable to both (1) economic benefit of discount purchase of the underlying stock at the time of the option exercise and (2) capital gain (or loss) by the sales price over (or under) the market price at the time of the option exercise.

- Non Tax-Deferral type (Non-Statutory) Stock award unqualified for statutory stock option is charged income tax on the economic benefit of discount purchase below the market price as salary income at the time of either (1) grant of the award, (2) vesting (no longer subject to substantial risk of forfeiture) or (3) exercising the option. After vesting/exercising, the employee or the director holds the underlying stock as a stock investor. Subsequent sale of the underlying stock is treated as straightforward sale of the stock subject to capital gain taxation.

|

Grant |

Vesting/Exercise |

Sale |

| Tax Deferral (Statutory stock option) | Non-taxable | Non-taxable | Capital gain/loss |

| Non Tax-Deferral (Non-Statutory) | Taxable salary income | Non-taxable | Capital gain/loss |

| Non-taxable | Taxable salary income | Capital gain/loss |

(1) Dividend paid on restricted stock before vesting is treated as;

- (USA) Additional compensation,

- (JPN) No established rule, but likely to be dividend income.

- it is capital gain of stock attributable to Japan’s statutory stock option.

- it is transfer of more than 5% of listed (2% of unlisted) outstanding share of real estate holding company of which real estate located in Japan constitutes 50% or more asset in value.

- it is transfer of 5% or more of outstanding share of Japanese company by the non-resident who owned 25% or more share at any time during 3 years period before end of the year of the transfer.

3. Statutory stock plan

Major requirements of statutory stock option;

|

USA |

JPN |

|

| Incentive Stock Option, ISO | Employee Stock Purchase Plan, ESPP | Tax Qualified Stock Option | |

| Grantee | Employee not holding voting power more than 10% (Note) | Employee not holding voting power more than 5% | Director or employee not holding more than 10% (listed stock) or 30% (non-listed) |

| Exercise price | Not less than fair market value at the grant date | Not less than 85% of smaller of (A) fair market value at the grant date or (B) fair market value of the exercise date | Not less than fair market value at the grant date |

| Holding period | No transfer within 2 years from the grant nor within 1 year after exercise | No transfer within 2 years from the grant | |

| Annual ceiling | Value of stock (value as of grant) exercisable p.a. not exceeding | Exercise price not exceeding JPY 12 million in total p.a. | |

| USD100,000 | USD25,000 | ||

Stock option granted by foreign parent/subsidiary to purchase stock of such foreign company can be statutory stock option in US, but not in Japan because statutory stock option is available only to;

- Stock option issued by Japanese company, Or

- Newly established Japan affiliate for either Research & Development or supervisory business certified as an Asian Business Center under Act for Promotion of Japan. But it is rarely applied.

4. US tax on Stock option, Restricted stock, Restricted stock unit(RSU)

(1) US tax on statutory stock option (ISO, ESPP)Taxable income is not recognized until transfer of the underlying stock.

Chart 7.

Grant |

Exercise |

Sale |

| Non-taxable | Non-taxable | Capital gain/loss = Selling price minus exercise price |

(2) US tax on non-statutory stock option

Either (A) or (B) depends on availability of market price of stock option.

(A) Option with readily determinable value

If the stock option is actively traded on an established market or its value is otherwise measurable with reasonable accuracy based on certain tests, the option holder is taxed at grant on the value of option itself as salary income. But it is uncommon for employee stock option to have readily determinable value. Exercising stock option of (A) type is not taxable just like “plain vanilla” stock option, and the total of the exercise price and the taxable salary recognized at the option grant constitutes cost of sales (i.e. adjusted basis) under capital gain taxation.

Chart 8.

Grant |

Exercise |

Sale |

| Taxable salary income at fair market value of stock option | Non-taxable | Capital gain/loss = Selling price – Cost (the price paid + the amount already included in the income) |

| Stock holding period begins |

(B) Option without readily determinable value

This is common for the employee stock option. Stock option is taxable at the time of option exercise as salary income. Market price at the time of option exercise constitutes cost of sales (adjusted basis) under capital gain taxation.

Grant |

Exercise |

Sale |

| Non-taxable | Taxable salary income at fair market value of stock minus exercise price | Capital gain/loss = Selling price – Cost (the price paid + the amount already included in the income) |

| Stock holding period begins |

83(b) election (III.4. (3)) is not available to stock option.

(C) Discounted stock option

Non-statutory stock option with an exercise price less than fair market value of the underlying stock at the date of the grant (“discounted stock option”) is subject to Section 409A as nonqualified deferred compensation and taxed at the date of substantially vested (i.e. it is not subject to substantial risk of forfeiture) except in limited circumstances such as separation of service, disability, death, change in control of the business or unforeseen emergency. Nonqualified deferred compensation is charged also surtax equivalent to 20% of the deferred compensation and the interest as designated by Section 409A.

Chart 10

Grant |

Substantially vested |

Sale |

| Non-taxable | Taxable salary income at fair market value of stock minus the price paid. Additional surtax + interest charged up to the exercise | Capital gain/loss = Selling price – Cost (the price paid + the amount already included in the income) |

| Stock holding period begins |

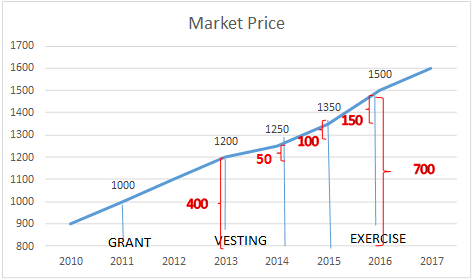

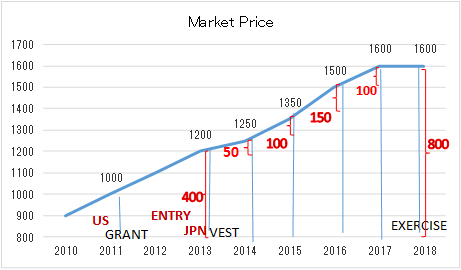

Chart 11: Exercise price: 800

Employee stock option granted in 2011 with the exercise price of 800 which is lower than 1,000 of the fair market value of the underlying stock at the time of the grant is regarded as nonqualified deferred compensation. The option becomes not subject to substantial risk of forfeiture at the end of 2013 and exercised in 2016. In this case, deferred compensation of 400 (fair market value of 1,200 over the exercise price of 800) is taxable at vesting in 2013. Thereafter non-qualified deferred compensation based on the year-end value of the underlying stock (50, 100 and 150) is taxable each year as well as surtax and interest until the exercise in 2016.

Risk of harsh tax consequence under 409A hampers especially private companies to issue employee stock option.

(3) US tax on restricted stock

Taxable at vesting similar to stock option without readily determinable value.

Chart 12

Grant |

Substantially vested |

Sale |

| Non-taxable | Taxable salary income at fair market value of stock | Capital gain/loss = Selling price – Cost (the price paid + the amount already included in the income) |

| Stock holding period begins |

• Transferable or release from substantial risk of forfeiture, whichever earlier

Section 83(b) election

83(b) election is elective to treat the stock taxable in the year granted, which can avoid salary taxation on appreciation of the stock value thereafter, while the taxpayer risks the forfeiture of the stock and the tax paid by 83(b) election but not refundable.

Chart 13

Grant |

Substantially vested |

Sale |

| Taxable salary income at fair market value of stock minus any payment | Non-taxable | Capital gain/loss = Selling price – Cost (the price paid + the amount already included in the income) |

| Stock holding period begins |

(4) US tax on restricted stock unit (RSU)

Similar to option without readily determinable value or restricted stock.

Chart 14

Grant |

Substantially vested |

Sale |

| Non-taxable | Taxable salary income at fair market value of stock | Capital gain/loss = Selling price – Cost (the price paid + the amount already included in the income) |

| Stock holding period begins |

5. Japan tax on Stock option, Restricted stock, Restricted stock unit

(1) Japan tax on statutory stock optionSimilarly to US tax, tax is deferred until transfer of the underlying stock.

Chart 15

Grant |

Exercise |

Sale |

| Non-taxable | Non-taxable | Capital gain/loss = Selling price - exercise price |

(2) Japan tax on non-statutory stock option

Similar to US tax, the fair market value of the underlying stock over the option exercise price at the time of option exercise is recognized as taxable salary income at the time of option exercise.

Chart 16

Grant |

Exercise |

Sale |

| Non-taxable | Taxable salary income at fair market value of stock minus exercise price | Capital gain/loss = Selling price - Fair market value at exercise |

| Stock holding period begins |

(3) Japan tax on restricted stock unit (RSU)

Similarly to US tax, taxable at the time of the vesting. Alternative like 83(b) election is not available.

Chart 17

Grant |

Substantially vested |

Sale |

| Non-taxable | Taxable salary income at fair market value of stock | Capital gain/loss = Selling price - Fair market value at substantially vested |

| Stock holding period begins |

6. Japan source allocation of benefit of discount purchase of stock

(1) Nature of the economic benefit of discount purchaseEconomic benefit of discount purchase of employee or director is generally regarded as salary income in Japan.

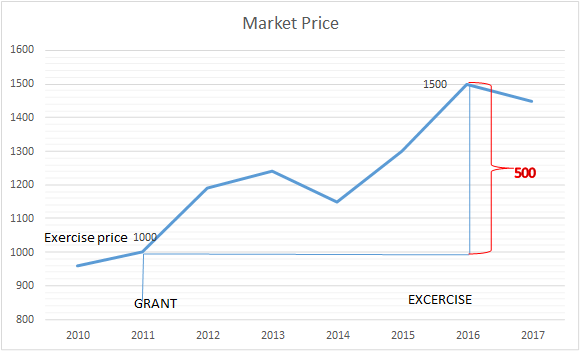

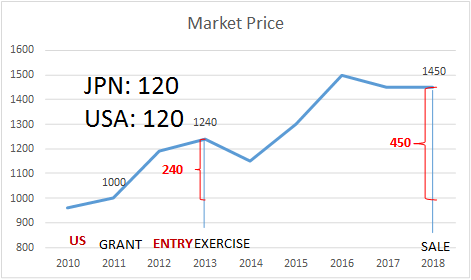

Chart 18 (Non-statutory stock option)

Benefit of discount purchase of the underlying stock is salary income in the amount of 500.

(2) Source allocation

Time basis source allocation in II.4.applies to multi-year remuneration arrangement like stock award. When the period of expatriate’s assignment in Japan (i.e. from the date of entry into Japan to the date of permanent departure from Japan) straddles the grant date and/or the vesting date, the economic benefit of 500 would be attributable partly to Japan source and partly to foreign source on the time basis of days of physical presence either inside or outside Japan.

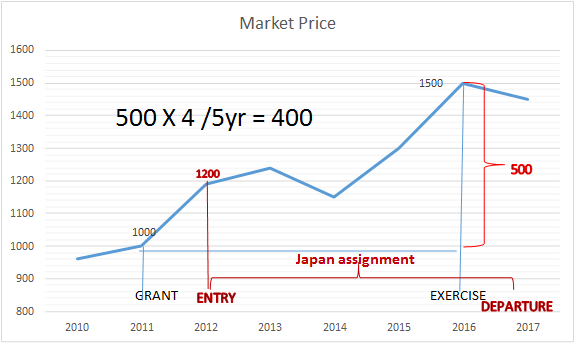

Chart 19

When an expatriate enters into Japan in 2012 one year after the grant date and exercises the option in 2016, Japan source is calculated roughly at 4/5 on the time basis allocation from grant to exercise. In actual tax calculation, the precise ratio should be calculated using the number of days with adjustment for days of overseas business trip and home leave during the period of Japan assignment. For example;

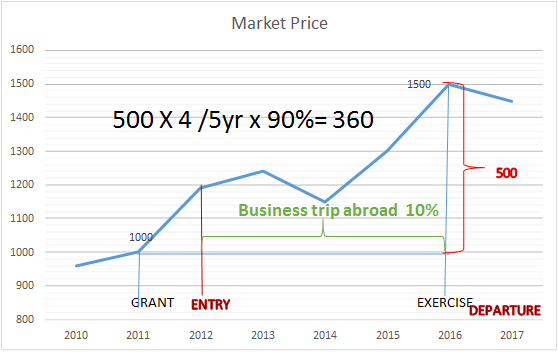

Chart 20

If days of business trips abroad spends 10% of days from grant to exercise, Japan source percentage reduces by 10% additionally.

(3) Source allocation after departure from Japan

Benefit of discount purchase of stock after permanent departure from Japan is still subject to Japan tax to the extent of Japan source portion on the time basis. Tax rate of non-resident’s salary income is fixed at 20.42%, which is often lower than the resident’s progressive tax rate ranging from 15% to 56% (Chart 4). It is a common practice to appoint a tax representative in Japan before permanent departure to administrate Japan tax affairs on behalf of the taxpayer.

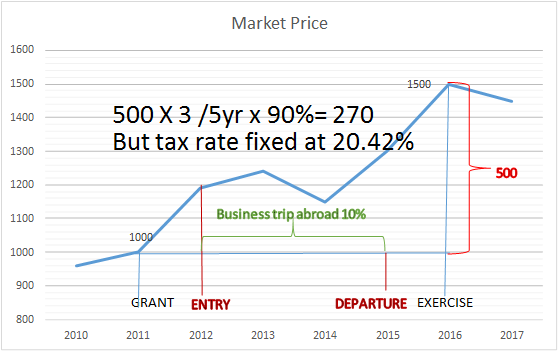

Chart 21

In case of 5 years period from grant to exercise, an expatriate lived in Japan for 3 years during which he (or she) spent 10% for overseas business trips before permanently departure from Japan. Japan source income is allocated on time basis to be 270 taxable at the fixed rate of 20.42%.

(4) Difference between US and Japan on source allocation of stock option

Both US and Japan generally apply time basis to source allocation for salary income as described in II.4. However the base period of the source allocation ends on the date of vesting of the option (conditions for option exercise has been satisfied) in US tax but on the date of option exercise in Japan tax. Not only Japan but also UK and Canada concluded tax treaty with US setting forth the same ending date rule.

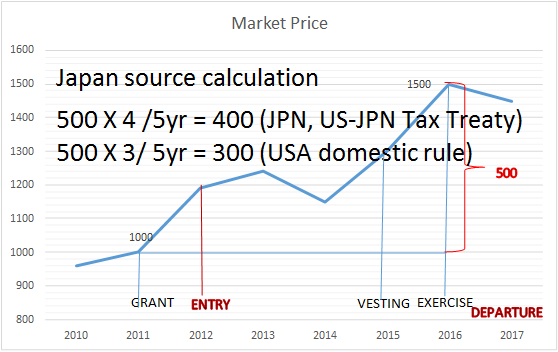

Chart 22

Option exercise one year after the vesting raises difference in Japan source allocation between 3/5 by US domestic rule and 4/5 by Japan rule and US-Japan tax treaty rule. Restricted stock and RSU are taxable at vesting in both countries and so the same allocation base is expected.

7. Employer’s report of foreign parent company’s stock based compensation

In Japan, the local employer is statutory requested for annual report to the tax office on each employee’s and director’s (including ex-employee, ex-director and those of the non-resident) benefit from stock based compensation (including stock equivalent cash award like phantom stock) from the foreign parent company (50% or more holding directly and indirectly) or the foreign head office with following details; name of employee or director, its address, date of vesting/exercise, nature of benefit, value of benefit, number of underlying stock, unit value, currency, date of grant, type of award, total number of stocks or other benefits granted, name of the grantor (the parent company or the head office), the country of the grantor, acquisition cost (exercise price, if any).It is advisable, not statutory required though, that the local employer provides copy of the report to the relevant employee and director to avoid discrepancy from the taxpayer’s individual income tax return.

8. Foreign tax credit

(1) FormulaTo eliminate income tax duplication between countries, foreign income tax paid is creditable against domestic income tax (“Foreign Tax Credit, FTC”) to the extent of the domestic income tax generated by the foreign source income based on the following formula;

FTC limit;

| Domestic income tax | X | Foreign source income Total taxable income |

Foreign income tax in excess of FTC limit carries forward to subsequent years.

Both US and Japan apply this formula with some differences as follows;

Chart 23

|

USA |

JPN |

| FTC eligible taxpayer | US citizen, Resident alien | Resident |

| Calculation unit of FTC limit | Each 5 category of income | Overall income |

| Adjustment of foreign source income for FTC purpose, e.g. qualified dividend and/or capital gain to balance with domestic reduced tax rate | Yes | No |

| Carry back | 1 year | N/A |

| Carry forward | 10 years | 3 years |

(2) Single “basket” in Japan FTC calculation

Japan’s FTC limit calculation on single unit (or to say “basket”) of aggregated incomes regardless of tax rate difference on income type could allow FTC disproportionately to Japan tax rate actually levied like following example;

| Japan FTC calculation of permanent resident | ||||

| Taxable income | Tax rate | Income | Foreign tax | Japan tax |

| (1) Foreign source capital gain | 100 | |||

| Foreign tax | 30% | 30 | ||

| Japan tax | 20% | 20 | ||

| (2) Non-foreign source any other income | 500 | |||

| Foreign tax | 0 | 0 | ||

| Japan tax | 40% | 200 | ||

| Total | 600 | 30 | 220 | |

| 220 x | 100 600 |

= 36 |

(3) Director’s remuneration

FTC formula accentuates absolute requirement of foreign source income for tax credit, while director remuneration has difference in source allocation and taxation between countries as addressed in II.4. When an US citizen (or resident alien under US tax like Green card holder) in Japan is a board member of US company and works only in Japan thus “no foreign source”, salary income of such remuneration is taxable not only in Japan but also in US because of worldwide income taxation for US tax purposes (Chart 2). Tax duplication in this case is relieved by US-Japan tax treaty which deems the income taxed in US to be US source income for FTC purposes replacing time basis allocation. Tax duplication in director’s remuneration and the remedy partly depend on the other tax jurisdiction and/or tax treaty concluded with Japan and do not always work out. But recent Japan tax reform and practice extends the idea of US-Japan tax treaty’s “replacing time basis allocation” to other tax treaty partners and deems the income taxed in accordance with the tax treaty by the treaty partner not limited to US to be foreign source income for Japan FTC purposes. When Korean company’s director resident in Japan does not work outside Japan, Korean tax on Korean company’s director remuneration was previously not creditable against Japan tax but currently creditable against Japan tax in Japan FTC.

9. US―Japan tax treaty on stock option

Tax treaty is another relief from tax duplication by ruling taxation right;- Country of resident has the primary right to tax on capital gain

- Country of income source has the primary right to tax on salary income.

Chart 24

| Country | Stock option | Residency Status at; | |

| Exercise | Stock sale | ||

| JPN | Statutory | Non-resident | Non-resident |

| USA | Non-Statutory | Resident | Resident |

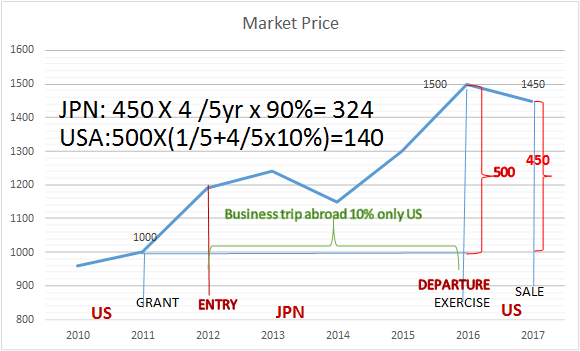

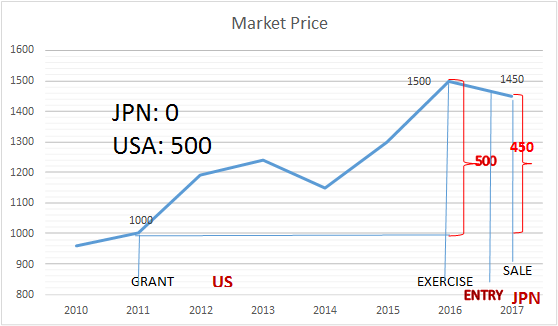

Chart 25

Japan tax on Japan’s statutory stock option defers until sale of the underlying stock under capital gain taxation, (Scope of Japan tax on non-resident includes the capital gain of Japan’s statutory stock option as addressed in III.2 (Note)(2)), while US-Japan tax treaty allows Japan to tax on Japan source portion of salary income. Due to salary income of 500 larger than capital gain 450, 450 instead of 500 is allocated on the time basis to Japan 324 as Japan source subject to capital gain taxation according to Japan National Tax Agency’s advance inquiry. It is expected that the benefit of the option exercise 500 is portioned to US source in the amount of 140.

10. Relief of tax duplication by US-Japan tax treaty and foreign tax credit

Relief from tax duplication on non-statutory type of stock option occasionally requires both tax treaty and foreign tax credit as follows;Chart 26

| Country | Stock option | Residency Status at; | |

| Exercise | Stock sale | ||

| JPN | Non-Statutory | Permanent resident | Resident |

| USA | Non-Statutory | Non-resident | Non-resident |

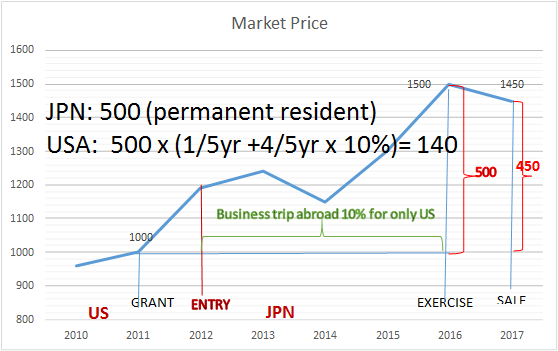

Chart 27

Taxable income;

| Taxable income at | ||

| Exercise | Stock sale | |

| JPN tax | 500 | Capital loss Δ50 |

| US tax | 140 | N/A |

If the taxpayer is a non-permanent resident, tax treatment changes as follows;

Chart 28; Taxpayer: non-permanent resident in Japan

| Country | Stock option | Residency Status at; | |

| Exercise | Stock sale | ||

| JPN | Non-Statutory | Non-Permanent resident | Resident |

| USA | Non-Statutory | Non-resident | Non-resident |

| Taxable income at | ||

| Exercise | Stock sale | |

| JPN tax | 360: Tax scope on non-permanent resident (Chart 1) | Capital loss Δ50 |

| US tax | 140: US-Japan tax treaty allows US tax on US source | N/A |

11. Tax duplication due to limit of Japan FTC carry-forward

Carry forward of Japan FTC expires in 3 years (Chart 23). Foreign tax paid over 3 years ago is not creditable in Japan leaving tax duplication unrelieved in Japan.Chart 29

| Country | Stock option | Residency Status at; | |

| Exercise | Stock sale | ||

| JPN | Statutory | Non-permanent resident or Permanent resident |

Non-permanent resident or Permanent resident |

| USA | Non-Statutory | Non-resident | Non-resident |

Chart 30

Japan tax on Japan’s statutory stock option defers until sale of the underlying stock as capital gain taxation, while US-Japan tax treaty allows US to tax on US source portion of salary income of 120. When the year of US tax payment on US source of 120 is 4 years or more prior to the year of the transfer of the underlying stock, US tax on 120 is not creditable against Japan tax on the capital gain, leaving tax duplication on US tax on 120 unrelieved in Japan. Of course US citizen or resident alien has a chance to mitigate a part of the tax duplication through US FTC or itemized deduction in US tax later.

Consequence is significant in case of discounted stock option taxable for US tax at the vesting and annually thereafter until the option exercise. When the year of US tax payment on the vesting is over 3 years prior to the year of the option exercise, US tax on the vesting is not creditable against Japan tax on the benefit of the option exercise.

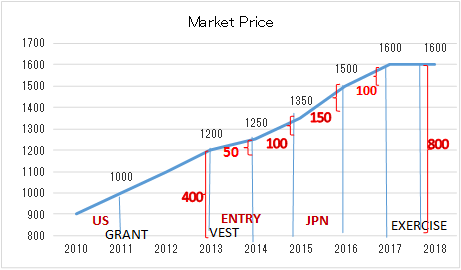

Chart 31 Discounted stock option: exercise price 800

| Country | Stock option (Discounted stock option) | Residency Status at; | |

| Vesting | Exercise | ||

| JPN | Non-statutory | Non-permanent resident or Permanent resident |

Non-permanent resident or Permanent resident |

| USA | Non-Statutory | Non-resident | Non-resident |

Chart 32

US tax paid on US source portion of the vesting of 400 becomes out of date for Japan FTC in the year of the option exercise therefore not creditable against Japan tax on 800 (or Japan source portion of 800 in case of non-permanent resident), leaving tax duplication on US tax on 400 unrelieved.

Timing difference between countries on taxable event is prominent at 83(b) election on restricted stock. When a tax payer elects 83(b) on restricted stock and seeks US tax on the grant to be creditable against Japan tax on the vesting later, the year of the vesting should be within 3 years after the year of US tax payment on the grant.

12. Tax duplication due to foreign tax paid during non-resident period

Foreign tax paid before entry into Japan is not creditable against Japan tax, resulting in tax duplication as follows.Chart 33

| Country | Stock option | Residency Status at; | |

| Exercise | Stock sale | ||

| JPN | Statutory | Non-resident |

Non-permanent resident or Permanent resident |

| USA | Non-Statutory | Resident | Non-resident |

Chart 34

Japan tax defers until transfer of the underlying stock as capital gain taxation is preceded by US tax at the option exercise. Japan FTC rules out foreign tax paid before entry into Japan resulting in the tax duplication unrelieved in Japan. Of course US citizen or resident alien has a chance to mitigate a part of the tax duplication through US FTC or itemized deduction in US tax later.

The exposure would be worse in case of discounted stock option;

Chart 35

| Country | Stock option (Discounted stock option) | Residency Status at; | |

| Vesting | Exercise | ||

| JPN | Non-statutory | Non-resident |

Resident |

| USA | Non-Statutory | Resident | Non-resident |

Chart 36

US tax at the time of the vesting before entry into Japan cannot be creditable against Japan tax at the time of exercise, leaving so significant tax duplication unrelieved that nothing might be left after tax.

The same story could be applicable to 83(b) election on restricted stock due to timing difference between countries on taxable event.

Protocol of US-Japan tax treaty remarks that the competent authorities will explore to resolve unrelieved tax duplication by mutual agreement, but it would cost too much time and money to be practical in many cases.

IV. TAX PLANNNIGN FOR EXPATRIATES

Mostly not limited to the stock award, following ideas would help the employer planning tax-efficient compensation to deploy international workforce and the expatriate saving income after tax.- Avoid appointment of registered director of Japanese corporation.

Director remuneration paid or born by Japanese corporation is regarded as entirely Japan source income (Chart 4), which would be otherwise allocable partly to foreign source income (II.4) if the taxpayer was employee during the initial 5 years period after entry into Japan as a non-permanent resident (Chart 3) - Limit Japan assignment up to 5 years

Residency in Japan over 5 years is the permanent resident taxpayer whose tax base extends to worldwide income (Chart 2 and 3). - Pay outside Japan

Foreign source salary of non-permanent resident is not taxable unless it is paid in Japan or remitted into Japan. (Chart 4) “Salary payment outside Japan” is such that salary is administrated outside Japan usually by the foreign parent or the foreign head office, which is not obliged to withhold Japan income tax from the salary. Overseas remittance to bank account outside Japan form the payroll administration in Japan is included in “payment in Japan”. Award of foreign parent’s stock is generally regarded as payment outside Japan. - Do not remit the foreign source income into Japan

Foreign source income (not limited to salary income) of non-permanent resident is taxable if it is paid in Japan or remitted into Japan. (Chart 1). Regardless of the remitter either the taxpayer itself or anyone else, the tax authority is likely to deem overseas remittance into Japan to be attributable, at least partly, to foreign source income paid abroad because the source of the remittance, probably mixture of various sources, is difficult to be identified and “money cannot be colored”. Overseas remittance into Japan over JPY 1 million is automatically reported to the tax authority by the financial institution. - Defer taxable event until permanent departure from Japan

Tax rate on non-resident’s salary income at fixed rate of 20.42% is generally less than the tax rate on resident salary income at progressive ranging from 15% to 56% on the aggregated basis (Chart 4). It is advisable to time taxable event by reference to the net benefit after tax. - Accelerate taxable event before the period of permanent resident

Scope of Japan income tax extends to worldwide income generally in 5 years after the expatriate’s entry into Japan (Chart 3). Non-permanent resident’s foreign source income is not taxable if it is not remitted into nor paid in Japan (Chart 2). When the expatriate has discretion to realize salary outside Japan like exercising employee stock option and has substantial days of overseas business trips, it is likely to be tax preferable for the non-permanent resident employee to trigger such taxable event before change of the taxpayer’s status to a permanent resident, unless the taxpayer expects to leave Japan permanently as addressed in 5 above. - Estimate taxation on stock award across the countries

Taxable event, tax base, tax rate, application of FTC, tax treaty and other relevant tax information should be reviewed to see net benefit after tax at each timing of grant, vesting/exercise and transfer. - Minimize country difference in taxation

Different taxation between countries might result in tax duplication. Answer would include;

(1) Conclude taxable events in a single country

(2) Time the taxable event before FTC carry-forward expire

(3) Adopt alternative remuneration form. Taxation of US and Japan on restricted stock, RSU, Phantom stock is more aligned than stock option’s.

(4) As the case may be, additional remuneration or tax gross-up should be addressed.

Ata Tax Accountant Office provides wide range of service on planning remuneration policy, administrating payroll, filing tax returns especially for expatriates in Japan, and more tailored to your each condition.

Disclaimer:

The information contained in this presentation is for general information only.

While very attempt is made to ensure that the information has been obtained from reliable source, no guarantee is provided to any information or the use of the information.

In addition, it should be understood that presentations of this nature are for purposes of education and discussion and necessarily involve simplification and compression. Descriptions of tax law in this presentation should be the subject of additional more detailed analysis before compliance or planning is implemented in reliance thereon.

All information is available without charge and is provided strictly not as rendering any professional service nor constituting professional-client relationship.

Any advice in this is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of (i) avoiding penalties that may be imposed under tax laws in any countries or (ii) promoting, marketing or recommending to another party any transaction or tax-related matter(s) addressed herein.

In any event, Ata tax accountant office will not bear any liability or responsibility caused directly or indirectly by the use of the information on this presentation whether in whole or in part.

The information contained in this presentation is for general information only.

While very attempt is made to ensure that the information has been obtained from reliable source, no guarantee is provided to any information or the use of the information.

In addition, it should be understood that presentations of this nature are for purposes of education and discussion and necessarily involve simplification and compression. Descriptions of tax law in this presentation should be the subject of additional more detailed analysis before compliance or planning is implemented in reliance thereon.

All information is available without charge and is provided strictly not as rendering any professional service nor constituting professional-client relationship.

Any advice in this is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of (i) avoiding penalties that may be imposed under tax laws in any countries or (ii) promoting, marketing or recommending to another party any transaction or tax-related matter(s) addressed herein.

In any event, Ata tax accountant office will not bear any liability or responsibility caused directly or indirectly by the use of the information on this presentation whether in whole or in part.